This article series is now available as a professionally formatted, distraction free paperback or ebook to read offline at your leisure.

For a young man just beginning to establish his financial life, opening a checking account is a small, but important, step in that process. A checking account is the workhorse of your accounts. It’s for money that you plan on spending or transferring to another account quickly. Because of the ease at which you can deposit and withdraw from a checking account, it will likely be the hub of all your financial activity.

Below we provide important tips and considerations on opening your first checking account. (While you’re at it, open up a savings account too for your emergency fund.) For those of you who already have a checking account, we also provide some friendly reminders on managing it wisely.

What to Look for in a Checking Account

Not all checking accounts are created equal. Some banks offer higher than average interest rates, while others offer accounts with no interest; some banks charge a monthly fee to keep your money with them, while others offer free checking accounts. Below we highlight a few things to consider when selecting and applying for a checking account:

Look for free checking accounts, but understand that a free checking account isn’t really “free.” A free checking account is an account that doesn’t charge you a monthly service fee to keep your money in that account. Many banks used to offer free checking accounts without any strings attached, but those days are largely over. These days, most banks won’t charge you a monthly fee so long as you meet certain conditions. Usually the conditions are that you make a certain amount of direct deposits and debit card transactions each month, or you maintain a certain minimum balance.

If you fail to meet those requirements, the monthly service fee is around $5 at most banks.

Look for accounts with no minimum balance. When you’re young and just starting out in life, your cash flow is likely minuscule. When I was in college, it was common for my checking account to dip below $100 despite my best efforts at budgeting. If you have a bank account that requires a minimum balance and you dip below that number, you’re going to be slapped with a penalty. Many free checking accounts have no minimum balance requirement (but require you to make direct deposits or debit card transactions to keep the account free), so select one of those.

Avoid checking accounts that offer higher than normal interest rates. They look enticing, but they usually require a minimum balance of a few thousand dollars.

Look for accounts with online access. You want to keep on top of how much money is coming in and going out of your checking account. It used to be you had to religiously keep track of every single one of your transactions in a check register if you wanted to know how much you had in your account. Today most banks offer free online services that let you check your account online. Get one that does. Also check if your bank allows you to hook up your accounts with services like Mint, YouNeedaBudget, or Quicken. Keeping track of your checkbook on your computer is much easier than using the old pocket register.

Ask how check “holds” are handled. Let’s say you get a big fat $2,000 from Grandpa to help pay for school. You deposit it in your account. You’re ready to drop a $2,000 money bomb at the bursar’s office the next day, right? Nope.

Banks usually place “holds” on checks from other banks, especially out-of-state banks, for a few days to ensure the check or electronic deposit will be honored by the issuing bank. During this hold period, you won’t have access to the money you deposited. For checks from local sources, the hold period is usually two days; for out-of-state check sources, the hold period can be up to five days.

It’s good to know your bank’s policy so you don’t spend money that you don’t have access to yet.

Get an account with a check/debit card. Most banks offer customers a debit card when they open up an account. Debit cards offer the convenience of credit cards, without the crippling high interest rates. Whenever you swipe a check card, your checking account is deducted.

What’s the Difference Between Choosing Credit or Debit on Check Card Readers?

Whenever you swipe your check card at a store, you’ll often be asked to select “credit or debit.” While both options will result in money being deducted from your checking account, they each process the transaction differently.

If you select “credit” and your check card happens to be a Visa checking card, your transaction is verified with your signature (sometimes), and will be processed through Visa’s networks. The benefit to you for using your debit card as credit is that you get to take advantage of Visa’s added security options to prevent against fraudulent transactions. You can also earn reward points with certain cards. Store owners have to pay Visa a pretty hefty service fee (usually 2% of the transaction) every time you choose credit, which is why, you may have recently noticed the check card readers at your favorite store bring up debit as the default option, forcing you to press the cancel button, and select credit instead.

If you select “debit,” you’ll need to enter your four digit PIN. After you enter it, your transaction will be processed through an electronic funds transfer, and funds are taken from your account instantly. You don’t get the same protections on your purchase as you do when you select credit and debit transactions aren’t eligible for reward programs. You can, however, ask for cash back when you make a purchase using debit. That means if your purchase was $5, you can have the store debit your card for $25, and the store will give you $20 straight from the till. That comes in handy when you need cash, but don’t want to pay an ATM fee. Be aware that store owners, especially mom and pop places, prefer debit transactions because of the reduced service cost.

Look for a bank with plenty of ATMs in the area and ask about ATM fees. You’ll have those days when you need quick access to cash. That’s where ATMs will come in handy. But the convenience of ATMs come at a price. While most banks offer machines that don’t charge withdrawal fees for their own customers, banks will charge you a fee for using a competitor’s ATM. When you add that fee, to the fee, or surcharge, the competitor’s bank charges you to use their ATM, you’re looking at paying about $5 just to get your cash.

Should I Go With an Online-Only Bank?

In the past few years, the number of online-only banks has increased dramatically. Because they have less overhead than brick and mortar banks, online banks are able to provide higher interest rates and charge fewer fees. A few years ago, online banks like ING Direct (now Capital One 360 and Ally had crazy monthly interest rates between 2%-4%, but they’ve since gone down to about 0.8-1%. Not fantastic, but still better than most traditional banks.

While checking accounts from online banks provide higher interest rates than traditional banks, I’d still open your first checking account with a traditional bank. Here’s why.

Things take longer to clear with online accounts. The internet is supposed to make things faster. Online banks didn’t get the memo. Checks and even electronic deposits, however big or small, take forever to clear online banks. For example, when I make transfers from my main checking account to my emergency fund that I keep in an online ING checking account, it takes about three days before I have access to that money. For large deposits or transfers, the wait is longer. Not good if you need money to clear fast.

You can’t easily deposit paper checks or cash with online accounts. If you ever get a check or cash for your birthday from Aunt Gertrude, depositing that money into your online banking account can be tricky. Most online banks require all your transactions to be electronic. But there are some that allow you to mail the check or cash in. Even if you can mail the paper check, it will be a while before you have access to that money — you have to wait for the check to arrive at the online bank’s headquarters, and then you have to wait another couple of days before the check clears.

However, some online banks are beginning to provide services that allow you to deposit a check from anywhere by simply snapping a photo of the check with your smartphone, so this is changing.

Many online banks also don’t provide wire services or cashier’s checks. That can get you into trouble when you’re buying a car or a home (or posting bond to get someone out of jail!), as those transactions often require a cashier’s check. If all your money is in an online bank on closing day, you’re sunk.

You get better service with traditional banks. The only customer service you get with online banks comes by phone or email, but there are some issues that are more easily done face-t0-face with a teller. Traditional banks also typically have a network of fee-free ATMs in your area; not so with online banks.

What You’ll Need to Open a Checking Account

Wipe that smile off your face. Haven’t you ever seen a 50 year old grown man apply for his first checking account before?

Opening a checking account is a breeze. Just walk into the bank and inform the teller that you’d like to open an account. All you have to do is fill out a short application, show the teller your photo ID, and deposit some money to open up an account. The amount you have to initially deposit will vary from bank to bank — some require only $1, while others ask for $50, $100, or even $250.

Some banks even let you open up an account online, but you’ll have to have an account at another institution that you can use to fund your new account.

How to Write a Check

Because we don’t typically write checks every day, when it comes time to do so, it’s easy to mess up. Here’s how you do it:

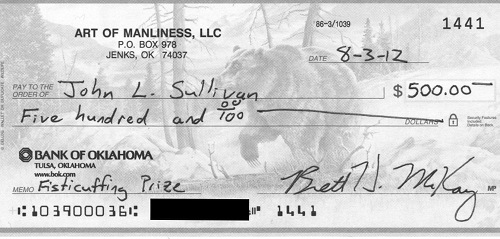

1) Always date your checks. 2) Write the name of the person or business you’re paying next to “Pay to the order of.” 3) Write the amount of the check in numeric format. You should start as far over to the left as possible. This prevents anybody from slipping in an extra number or two. 4) Write out the amount of the check in words. For the cents part, use a fraction with 100 as the denominator. In this example since it was $500 even, I wrote out “00/100.” 5) Sign the check. 6) It’s a good idea to write a short note on what the check was for. It helps with accounting.

Managing Your Checking Account

Now that you have a checking account, it’s important that you manage it effectively. If you don’t keep on top of the money coming and going from your account, you risk the embarrassment and financial penalties that come from spending money you don’t have.

Opt-out of overdraft protection. Overdraft protection means that if you make a purchase with your debit card, and you don’t have enough money in your account to complete the transaction, the bank will “loan†you the money…and charge you a $25-$35 fee for their “generosity.” But that’s a big price to pay to avoid the embarrassment or inconvenience of having your card declined or a check bounce. And these fees can add up fast, because here’s what many consumers don’t know: most banks will purposefully process your largest transactions first, and then your smaller transactions after that. So let’s say you have $285 in your checking account, and you buy a coffee for $3.50 in the morning, a sandwich for $5 at noon, and then some college textbooks in the afternoon for $300. The banks will process the $300 transaction first, even though it was made later in the day, thus depleting your account, and then charge you a $35 overdraft fee for the textbooks, another $35 fee for the sandwich and another $35 for the coffee, and bill you for $105 in total overdraft fees. Ouch!

Banks used to automatically enroll their customers in overdraft protection programs, but a court ruling in 2010 made that illegal. You can and should opt out of overdraft protection. But because overdraft fees were a big moneymaker for banks, they still aggressively try to get you to sign up. Every time I check my bank account online, I get a pop-up that asks if I’m sure I don’t want to enroll in their overdraft protection program. You just have to say no and keep saying no.

Check your account weekly. Make a habit of checking your account online every week. Not only does this keep you abreast of how much you have in your account so you don’t overspend, it gives you a chance to check for errors or fraudulent transactions. If you notice any errors or possible fraudulent transactions, notify your bank immediately.

Also, sometimes when you have something set up on autopay, like a gym membership or Netflix, that makes a withdrawal from your checking account every month, even when you cancel the service, they can “forget” to stop charging your account. Be on the lookout for this.

Understand that the balance your bank statement says you have could actually be more than you really have. This is something that trips up a lot of young people when they first get a checking account. Your bank says you have $750 in your checking account, so you pay your $500 rent. A few days later you get notice from your bank that you’re being charged an overdraft fee and you have an account balance of -$50. What happened?

Well, a week earlier you wrote a check for $300 for tuition, but it still hadn’t cleared when you checked your checking account. After you sent a check to your landlord, the tuition check finally cleared, leaving you in the hole and facing a stiff overdraft fee.

Because of the delay between the moment the transaction occurs and when it actually posts, it’s important to track all your debit card transactions, ATM withdrawals, and checks written in a check register (You can use the old fashioned paper registers or a digital one like Quicken, YouNeedABudget, or Mint. I know some folks who use a simple Excel spreadsheet ). A check register lets you know how much you really have available in your account. Don’t think you can mentally keep track of it. At some point you’ll experience a brain fart. I know from experience.

Set-up online alerts for when your balance reaches a certain level. To play it safe, establish a base amount for your checking account that you’ll never go under. That small amount acts like a firewall for bounced checks. Take it a step further by setting up an alert with your bank’s online system that will notify you whenever your checking account balance gets within $50 of your minimum balance. Once you get the alert, cut back on spending and deposit some money.

Use direct deposit for your paychecks and pay bills online. Whenever you land a job, ask your employer to automatically deposit your paychecks into your checking account. You’ll have to sign a form and provide a voided check to get auto-deposits set up. Where available, pay as many of your bills online as you can and make them automatic. We’ll be talking more about that later this month.

Balance your checkbook monthly. You’ve probably seen your parents balance their checkbooks. Balancing a checkbook simply means reconciling the balance your bank says you have in your account with the balance you have in your records. Remember, with the delays between checks clearing, those numbers can be off.

People are divided on whether you need to balance a checkbook in our world of digital finances. But even with the speed of digital transactions, things can get off kilter in your account, so it’s not a bad idea to reconcile your account at least once a month. Money software like Quicken and YouNeedaBudget make this process a breeze. They’ll automatically reconcile your accounts with a click of a button. Sometimes, though, you’ll need to bust out the old pen and paper to do some figurin’. If that’s the case, follow these instructions from the fine folks at Mint.com.