Editor’s Note: This is a guest post from Jay Cross.

I don’t know about you, but I’m fed up with the ancient “college savings tips†so-called experts keep force-feeding us:

- “Fill out the FAFSA before senior year to maximize aid eligibility!â€

- “Buy used textbooks, you’ll save hundreds!â€

- “Apply for scholarships. Try FastWeb.com!â€

If you follow this advice, you will be thoroughly and totally prepared for college…in 1995. (You know, just in case that year ever comes back.) But in 2013, these strategies will get you slaughtered by the “Student Loan Industrial Complex.â€

The Stark Truth About Yesterday’s College Tips

- Many students don’t fill out the FAFSA at all, nevermind early. I didn’t. It’s long, tedious, and confusing. Even if you do, the skyrocketing cost of college makes student loans a “lose/lose†proposition. Either you don’t qualify (in which case you can’t get aid) or you do qualify (in which case you probably shouldn’t take it.) Today’s loans are causing some graduates to commit ACTUAL suicide after committing financial suicide.

- Textbooks, while 812% pricier than 30 years ago, are a tiny portion of your total college costs. Every penny helps…but buying used books doesn’t pay for college any more than clipping coupons pays for a mansion.

- Most people who apply for scholarships get nothing. It’s a near-universal waste of time.

Continuing to preach this outdated advice is worse than useless: it’s condescending. It actually patronizes how challenging it is to finance your education. Today’s students don’t need the marginal cost reducers of the past. They need to completely rethink their strategy and beat colleges at their own game.

In this post, I am going to share an uncommon approach that can help you graduate faster, avoid student debt, and jump into the job market with both feet beneath you.

Testing Out: The Best Kept Secret in Higher Education

Let’s say you’re just starting college and you need to earn all of those major-independent “general education†credits (i.e., English 101) that every student takes.

What do you do?

Option #1: Take a standard English course. You know what that means: classes, homework, tests, quizzes, projects, group assignments…ugh. 95% of students assume this is their only option.

Time: 4 months

Cost: $3,000+

Option #2: Take CLEP tests instead. These multiple-choice exams cover a full semester of material…and if you pass, you get the same credits you would have spent months in a classroom for.

Time: 2-3 hours

Cost: $80

CLEP offers 33 exams in five subject areas, is accepted for credit by 2,900 colleges and universities, and is proctored in over 1,800 test centers nationwide. Developed by College Board — the same organization behind AP courses and the SAT — CLEP measures your knowledge regardless of how you obtained it: independent study, internships, and work experience included.

CLEP is the most popular exam option, but not the only. Other formats include DSST, Excelsior/UExcel, and Thomas Edison State College (TECEP) exams. Every school decides for itself which tests to offer and how much of your degree you can test out of. At some schools, it’s 30 credits. At others, it might be 45. Still others, 60 or 90 or even the full 120 credits of a bachelor’s degree.

Regardless of the exact number of exam credits your school lets you earn, the savings potential is massive. And you don’t need to pray for scholarships or nebulous “aid†to get it. Testing out is completely within your locus of control: you just need to plan, prioritize and study like a gentleman scholar.

Even if your school only allows 30 exam credits, that’s still a quarter of your degree. You will save nearly $30,000 and graduate faster by not earning those credits in the classroom. I completed the final 30 credits of my degree via test-out and was the only person I know to graduate 100% debt-free. (Here’s my story, if you’re interested.)

Some people have heard of testing out, but most haven’t. Schools don’t shout from the rooftops about their test-out allowances. Why would they? Higher education is a business: the longer they can “keep you in the store†with costly courses, the more money they make. But this information is buried in your academic handbook under “alternative credit policies†or “transfer credit allowances.†Look for it.

Sadly, even students who have heard of testing out tend to use it for just one or two courses, not the majority of their degrees.

I believe students owe it to themselves to figure out the fastest and most affordable graduation path at their disposal, even if they don’t test out of absolutely everything.

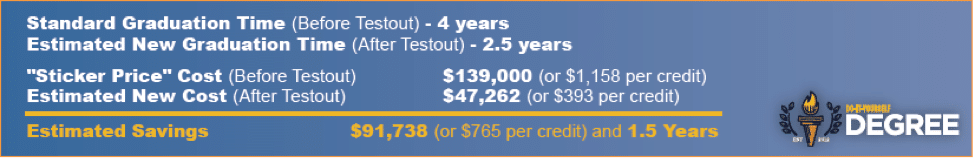

Case Study: Earning a $139K degree for $47K at Sacred Heart University

Enough theory. Here’s a real analysis I created to illustrate how powerful your test-out savings can be. In this example, we’ll assume you want a bachelor’s degree in psychology from Sacred Heart University, a small, expensive, highly-ranked private university in Connecticut.

Here is the research necessary to calculate how much time and money you can save by testing out:

- Determine the “full sticker price†tuition of a four-year degree at SHU (roughly $139,000)

- Determine which exam formats SHU offers (CLEP, DSST, Excelsior/UExcel)

- Determine how many exam credits SHU allows students to earn (90)

- Determine the course requirements of a psych degree at SHU (degree chart)

- Determine how many of those required courses have CLEP, DSST, or Excelsior/UExcel exams for you to take instead (25)

- Determine the costs of each of those exams ($80/each for CLEP and DSST, $100/each for Excelsior/UExcel)

- Assume you can study for and pass a new test every 2-3 weeks

I’m building an app to crunch this data automatically, but it can all be done by hand. If you wanted to test out of as much of a psychology degree as Sacred Heart will allow, here are your potential savings:

Every school should post an analysis like this on their website. Since they never will, you need to perform the analysis yourself.

Again: nothing says that you HAVE to test out of every subject a school will allow. There are valid reasons for taking a course in person: class discussions, mentorship from a professor, or simply not feeling comfortable studying for a tough subject on your own (I’m looking at you, fellow non-math people!)

Rather, the point of running an analysis like this is to figure out your options. With college being as costly as it is today, there is no excuse for not giving yourself the opportunity to say “yes†or “no.â€

The “Moneyball†Approach to Cutting College Costs

Here’s a useful analogy for how testing out fits into the overall picture of your college career.

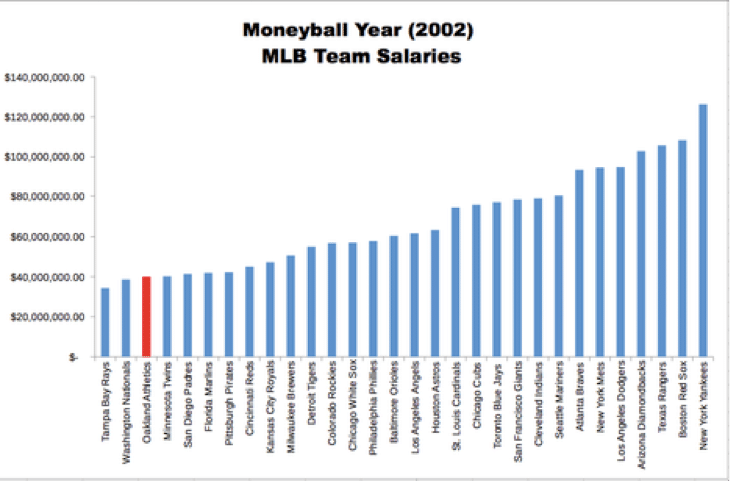

Think about Billy Beane, GM of Major League Baseball’s Oakland Athletics (and the protagonist of Moneyball.) Back in 2002, Beane knew the A’s could only spend a fraction of what richer teams like the Yankees had on hand.

So instead of trying to copy those clubs, Beane figured out a brand new way to build a baseball team.

Oakland used cutting-edge statistical analysis to find “misfits†— players who were overweight, or threw the ball side-armed, or couldn’t run quickly — and constructed its entire roster with them. The other teams laughed, but here’s the best part: the A’s wanted their bargain-priced “misfits†even more than the stars they couldn’t afford.

These oddball players had undervalued talents that led to scoring runs and winning games. Most importantly, they were cheap.

The Yankees — and all the teams attempting to emulate them — were asking, “How can we buy the biggest stars?â€

The A’s asked a totally different question: “How can we buy WINS (and runs, the building blocks of wins) for pennies on the dollar?†Beane didn’t care who his individual players were as long as the team was winning.

2002 was the perfect season to compare these approaches because the Yankees and A’s each won 103 games. The breathtaking difference? New York spent $1.5 million per win. Oakland, using their unique approach, spent just $250,000.

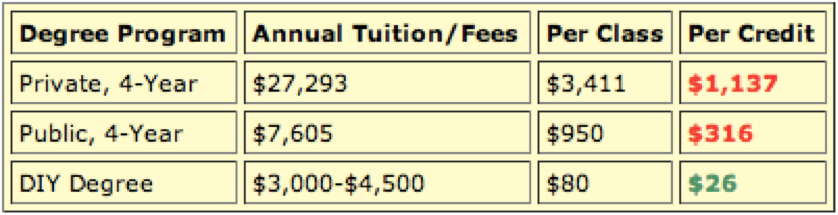

Here is a cost-per-credit analysis I created using average tuition figures at public and private four-year universities, as well as the cost of earning a “test-out†degree:

Sources: CollegeBoard and DIY Degree

Testing out is a “Moneyball†approach to higher education. “Cost per credit†is to college what “cost per win†is to baseball: the number you want to intelligently optimize. In college as in baseball, the way to win an unfair game is by taking a new approach to get the same results more efficiently.

Why You Should Look at College Like an Investment

If this post makes it sound like you’re “Frankensteining†your education, cobbling various exams and credit sources together to form a degree…you’re right. That’s exactly what I’m advocating.

This might seem strange at first, but I encourage you to look at it differently.

Why do we see college as this magical guarantee of financial success? It’s because of these oft-cited studies on how much more graduates earn over their lifetimes than non-grads. We hear sweeping statements (“people with bachelor’s degrees earn $1 million more!â€) and assume that it MUST be a great investment, no matter what it costs.

Actually, we don’t just assume it — we’re explicitly told that it’s true:

“Over a lifetime, the gap in earning potential between a high-school diploma and a bachelor of arts is more than $800,000. In other words, whatever sacrifices you and your child make for [a] college education in the short term are more than repaid in the long term.â€

That’s from CollegeBoard, the organization that makes the SATs. They’re basically telling you to just pay whatever a degree costs.

It’s horrible advice.

You don’t make huge financial decisions with simplistic rules like “whatever sacrifices you make are worth it in the long-term.†How is that any different than telling you to shoot first and ask questions later? No — you make huge financial decisions is by running the numbers.

Which brings us back to these studies on college graduate earnings. They aren’t “wrong,” but they are misleading.

Here’s why: earning a higher income doesn’t automatically mean you’re getting ahead. You can earn $20,000/year before college, get a $60,000/year job afterwards, and still be no better off. If you spend $100,000 for a degree (and take four years off of work to do it) you have incurred a huge financial and opportunity cost.

You took out a loan against your future earnings which must now be repaid over five, ten, maybe even fifteen or twenty years. Even then, once all the loans are repaid and you’ve earned back all the income you lost by not working, guess what? All you have done is break even!

You’re back at square one. Finally, after years of repaying loans and interest, you can start actually benefiting from the higher income you earned your degree for. Most college students don’t realize that this is what they’ve agreed to until after they graduate. They just see college as a magical guarantee of financial success. Yet whether they realize it or not, their student loans often chain them to a life of indentured servitude.

The return on an investment is inversely proportional to the time and money invested. In plain English: the longer it takes you to graduate, and the more you pay, the less valuable your degree ultimately is.

Testing Out Actually Delivers What Colleges Falsely Promise

Fortunately, the reverse is also true. The less time it takes you to graduate, and the less you pay for your degree, the more valuable it is.

By testing out, you are doing what so many students never do. You’re being strategic. You’re treating your degree as an investment, rather than a collegiate shopping spree. You’re being efficient by extracting the most value for the least cost.

Consequently, you actually will reap the rewards of higher postgraduate income. Since you didn’t take years off or incur costly loans, all of that extra money goes straight into your pocket.

If you are struggling to figure out how to afford college, I hope the test-out strategy is a breath of fresh air and a new lease on academic life. Please leave any questions in the comments. I’m happy to help anyone who needs it!

____________________

Jay Cross runs DIY Degree and helps students learn more, spend less, and graduate faster. His college acceleration strategies have been covered by Fox Business, Huffington Post, Popular Mechanics, Brazen Careerist, The Personal MBA, and I Will Teach You To Be Rich.

Tags: College