Welcome to Part II of our series that asks the question of whether or not college is necessary. In Part I, we took a look at the history of higher education in America. What started as a place for a small, elite group of students began turning into an American rite of passage in the early 1900s. Enrollment boomed, endowments skyrocketed, and the idea of college became imbued with a romantic haze that has endured until the present day.

This last decade, however, has started to show that four years of college immediately after high school may not be the best option for every student out there. Today, we’re going to look at the pros and cons a young man should consider before deciding to enroll in a four-year university.

While some of these pros and cons apply equally to both four-year and two-year schools, in general, they are specific to four-year schools. For example, while tuition costs are skyrocketing at four-year institutions (especially private ones), community college remains pretty affordable at an average of just over $2,000/year. And while it’s possible to form close relationships at a community college (even if those friendships aren’t quite as wacky as depicted on the eponymous television show), it’s harder to do because students don’t live on campus.

The reason we’ll be concentrating on the pros and cons of enrolling in a four-year school, particularly right after graduating high school, is because of the weight those particular institutions carry in the minds of Americans. The cultural pressure to go on to college after high school almost completely centers on enrolling in a four-year college. While plenty of students attend community and technical colleges, the majority of 18-year-olds that have graduated high school will attend four-year schools. In total, you see about twice the number of four-year students (~11 million) than two-year (~6.5 million).

There is still a certain stigma attached to two-year schools – that they’re only for those who don’t get in or can’t afford “normal†college. Without a doubt the cultural perception is that two-year schools are a step down from four-year institutions. It’s an unfortunate side effect of the blanket prestige given to four-year schools.

But is that level of prestige truly deserved? Should attending a four-year college be the aim of every high school senior in the country? In this post we will examine the positives and negatives of attending a four-year institution with the goal of receiving your bachelor’s degree.

The Cons of Attending a Four-Year College

Tuition Costs Are Skyrocketing

Given the fact that we are still experiencing the aftershocks of the 2008 recession, it’s inevitable that many of these cons are related to money. I’ll try to address a few specific concerns within the broader category of college economics.

The first is that the cost of tuition is growing at a rate far higher than the general inflation of the economy. What this means is that more and more students (and their families) aren’t actually able to afford college, but enroll anyway, because it’s still just what you do.

Since 1990, just 24 years ago, the price of a four-year institution has soared 300%. That’s an eye-popping number to be sure, but you can say that about a lot of products. You have to factor in general inflation numbers in order to figure out the real significance. When we do that, we see that in those 24 years, tuition has risen at a rate that is 2.5-4 times that of the national inflation, depending on who you ask. Theoretically, when disproportional inflation occurs, that product becomes a luxury good. That has not been the case with college, however, as enrollments only continue to go up. (Minor caveat: enrollments dropped among all college types slightly in 2013 — by 2.3% from the year prior — but the majority of that number was in fewer adult learners enrolling at either for-profit schools or public community colleges.)

Ultimately this means that families are spending money they don’t have for a luxury product they can no longer reasonably afford. At an average cost of around $20,000/year for college, families are looking at an expense that is 38% of their entire household income. That’s a rate at which most families would be denied a mortgage.

Unfortunately, there’s no real end in sight. In 2011 alone, the cost of public schools rose 5.4 percent and private schools rose an astounding 8.3 percent, both of which significantly outpaced the 3 percent inflation for the economy. Wages simply aren’t keeping up with college costs, and Americans have not yet been able to cut back on this particular expense.

A Degree Isn’t Yielding the ROI That It Used To

Tuition may be going up, but a college degree is still thought to be a good investment. But it could be argued that while the cost of college has been rising, its actual value – on many different fronts – has been declining.

The popular statistic thrown around in regards to the long-term, monetary value of a college degree is that graduates earn, on average, $1 million more over the course of their lifetime than non-degree holders. To a high schooler, or even a parent of a student, that’s a number that cannot be ignored.

Unfortunately, it’s a little bit misleading, and also simply not as accurate post-recession. That $1 million number is quite top-heavy. If you make it into a top university and graduate with honors, your earnings are likely to be much higher than if you scrape by at Podunk U. Those at the very top are well above that $1 million figure, and skew the results for the rest of us. A recent study by PayScale.com found that there are only 72 schools (out of 2,700 4-year schools in America) at which earning a degree can get you a $1 million return on investment over high school grads. The median is closer to $500,000 according to that report, which while still being a lofty number, is half of what prospective college goers are often promised.

That $1 million number may have been true 12 years ago when it was released in a report by the US Census Bureau, but with the recession, and wage inflation being lower than general inflation, to continue to throw that number around today is irresponsible.

At one time, college certainly was a reasonable investment. Tuition was low ($1,200/year in the 1970s at public schools, including room and board!) and therefore affordable, and you’d be rewarded with a well-paying job. Forty years ago, over a third of the labor force didn’t even have four years of high school education, while only 10 percent of the population had a degree. That made college graduates more of a hot commodity, and in the mid-nineties, at the height of America’s economic success, the unemployment rate for college graduates was around 2%.

That time is long gone. Tuition has become damn-near unaffordable for most, and well-paying jobs (heck, jobs period) are nowhere near the guarantee they once were after you graduate. In fact, recent grads (ages 20-24) have an unemployment rate that is now at about 7.8%. That’s higher than the national unemployment, and close to three times higher than it was about 20 years ago. This means you’re accumulating mountains of debt (which was not the case even a decade ago, when less than one-third of graduates used student loans – more on that below) that will strap your financial decisions for decades after graduating, and you may not even have a means of paying it off. Does that sound like a good investment?

Another factor that has to be considered in this topic of ROI is your lost potential income during your college years. Let’s consider even the lowest wage scenario. If you make minimum wage, with zero raises over the course of four years, you’ll have made $56,000. That’s not chump change, and it’s likely you’d make much more than that. I had jobs in high school that were well above minimum wage, and you’re almost guaranteed raises if you’re competent. Then factor in the out-of-pocket expenses as well as the debt for someone in four years of school (which is generous in itself – the average these days for graduation is closer to 5 and even 6 years). You’re looking at anywhere from $25,000 to $100,000 for the average student. Then you consider interest on those student loans, and the fact that you’ll take an average of 16-18 years paying them off (during which that high school graduate likely moved up the ranks and is now earning a decent wage), and all of a sudden the difference is not as great as it once appeared in terms of total earnings. While there is still a difference in the earnings of college grads vs high school grads (I’ll cover that below in the “Pros†section), it’s not as great as what it used to be, and it’s not as great as what is often promised by college admissions offices.

Loans and Debt are Crippling College Grads (and the Economy)

In 2010, the total amount of student debt overtook the total amount of credit card debt in America. As of 2013, there is $1.2 trillion in outstanding student loans – that’s over $3,700 for every man, woman, and child in America. As our nation recovers from the recession, we’ve actually managed to cut down our credit card and mortgage debt. The one area that’s still growing? Student debt.

The major issue, economically, is that about $1 trillion of that is backed by the federal government. This puts the American taxpayer at risk as the creditor, which means we the people carry the burden of unpaid student loans. And that burden is only increasing. Recent reports show that 10% (and the number is increasing) of student loans are in default. On government loans, this means they haven’t been paid in 9 months. Furthermore, only 4 in 10 student loan borrowers are paying back their loans at any given time. Graduates are not able to pay back their debt, and that hurts their credit tremendously, which impacts all future financial (and life) decisions, including car purchases, home purchases, even marriage.

For this reason, many economic experts are calling this student loan crisis “the next housing bubble.†In the mid-1990s, banks were giving out mortgages to anyone and everyone who applied. There wasn’t much due diligence in terms of the borrowers’ ability to pay back their loans. Eventually, that came to bite banks in the rear, and they needed a hefty (to say the least) government bailout in order to survive. The same thing is happening with student loans. Schools give out tens of thousands of dollars to students (and families) who may not have any realistic ability to pay back those loans. Eventually, as many experts are warning, this will create the same effect as what happened to our economy in 2008.

Another crippling factor of student loan debt is that it’s not eligible to be discharged by declaring bankruptcy. While not affecting a great number of people, you never know when something catastrophic could come along and you need the fresh start that bankruptcy sometimes provides for those in dire straits. If you’re not able to discharge student loans, it could hamper your ability to ever recover financially. It’s worth noting that private student debt is far more dangerous than government student debt. While both are non-dischargeable, government loans have low, fixed rates (for the most part – depending on the mood of congress), and repayment can be adjusted based on income (although doing so increases the length of the loan and the interest).

Two-thirds of all students are graduating with debt, and the average amount owed is over $26,000 (a 43% increase from just 7 years ago – right before the recession). With interest, that puts your average monthly bill at $320. When you get married that bill can double, and you’re looking at a lot of money each month that isn’t going into savings, isn’t going towards other debt (credit, car loans, mortgages), isn’t going towards helping the American economy recover.

College Doesn’t Necessarily Grow Your Mind

The two reasons for attending college that are foremost in people’s minds are increasing one’s earning potential and sharpening one’s mind. As just discussed, the value college offers on that first front has been falling. And unfortunately, the benefits of higher education on one’s mind have been shriveling as well.

Attending college isn’t necessarily the mind-expanding endeavor it’s always been made out to be. While it’s assumed you’ll be a better critical thinker, problem solver, philosopher, etc., those benefits don’t automatically accrue simply by sending in your tuition check. One study from 2011 found that about half of college students see no improvement in their problem solving, reasoning, or writing skills in their first two years, and over a third see no improvement during the entirety of their college experience. Sure, the environment can lend itself to growth, but attending college without vigorously applying yourself won’t magically sharpen your cognitive powers.

At the heart of the problem is a shift in attitude amongst colleges and students alike towards viewing education as just another consumer commodity. Colleges see their students as customers, and the customer is always right.

Take the practice of students evaluating their professors. Gaining popularity in the 60s and 70s when universities started to become more student-driven, evaluation forms are now a top metric in professor reviews. Even if subconscious, this means professors are now catering more towards making the students like them in the short-term rather than providing the kind of challenging, mind-expanding coursework that will benefit them in the long-term. Profs don’t want bad marks from students for being boring or too hard, so they water down their requirements in order to earn a thumbs up.

Closely related to this is the softening of grading standards. At Harvard, for example, the most common mark given is a straight A. The pattern is repeated at other Ivy League schools as well, where upwards of 60% of all grades given are in the A range. Rising to the very top of the class no longer requires the maxing out of one’s cognitive abilities. Some schools are doing something about this rampant grade inflation by instituting limits on the number of A’s awarded, but it’s certainly not widespread practice.

College Doesn’t Necessarily Prepare You for the Real World

Let’s go over how I spent my four years of college:

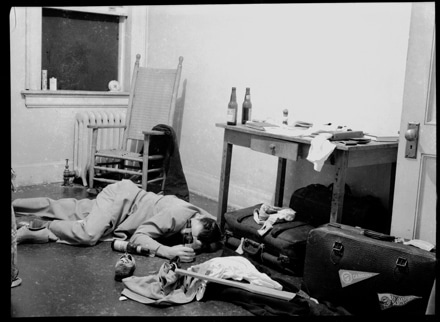

- I spent four years in a dorm room, two of those years with roommates, two by myself as an RA. I had no kitchen in my room. I had no bathroom in my room. I had a bed, a desk, and a TV.

- I had a meal plan for four years. I got two meals a day from a variety of cafeterias, and often just skipped a meal out of sheer laziness.

- I spent hours each day playing video games with friends.

- Related to the above, I was awake until well past midnight most evenings, and woke up around 7:30am for early classes.

- I skipped class fairly regularly, with no real punishment. Sure, a grade may have slipped a notch or two, but that didn’t have any impact on my life.

- My bills amounted to gas, car insurance, and my cell phone – totaling probably around $150/month.

Does that sound like real-world experience? Another of the benefits that college supposedly imparts is that it prepares you for the real world and helps you develop into a mature adult. I can’t say I really received that. Quite to the contrary – when one places the responsibilities and expectations of a college student up against those required outside the corridors of higher ed, yawning gaps appear.

Once you’re out on your own, if you skip or roll in late to work like you did for class, you’ll get canned. If you wait for a magical elf to come in and clean your bathroom, it will quickly turn into a cesspool. If you haven’t learned to budget, there can be serious consequences.

College has in many ways become a womb of relatively carefree living. It’s sure fun while it lasts, but once you have to step into the light, it can be pretty blinding. The adjustment to living in the real world can be difficult – practically and emotionally. Young men often graduate without the life skills and decision-making abilities they need to navigate the next part of their lives. They may find themselves floundering in new responsibilities they have no experience in shouldering. Acute nostalgia for their undergrad days can set in, leading them to attempt to recreate those conditions to increasingly diminishing returns.

Ideally, one’s teenage and early twentysomething years should be like a gradual on-ramp to adulthood, where you slowly accumulate the life skills and mindset you need to thrive as a grown man. Instead, moving from college to the real world now more often feels like getting shoved off a cliff.

College Isn’t Preparing Students for the Job Market

Many employers have said that the problem with the economy in this country is not necessarily a lack of jobs, but a lack of qualified people to fill those jobs. In fact, a survey by the Accrediting Council for Independent Colleges and Schools revealed that less than 10 percent of employers believe that colleges do an excellent job preparing students for the working world (whereas well over 90% of provosts believe their graduates are prepared – boosterism at its finest). And 50% of employers noted that it is difficult to find qualified prospects for the positions they’re trying to fill. Rep. Virginia Foxx, the chairwoman of the U.S. House of Representatives higher-education subcommittee, says, “Colleges and universities are pandering to the students and giving them what they want, instead of what the employers want. I don’t think you have to make a distinction between getting skills and getting an education. We need to do both.”

Our colleges are simply no longer qualifying our students for gainful employment. The loosening of academic standards mentioned above not only negatively impacts the quality of the critical thinking and reasoning skills acquired in college in a general sense, but in a more tangible way, it makes students ill prepared for the job market.

For instance, in our tech-obsessed world, many students want to be trained in using social media or developing their technology skills. But only 5% of business executives (the ones making the decisions) believe that to be a top-three skill for entering the business world. Those top three skills? Problem solving, collaboration, and critical thinking.

Another major deficiency is writing and oral communication; a hefty 80% of employers wish schools would put more emphasis on those skills. Not all students are required to take basic writing classes, but absolutely should be, based on the needs of the marketplace. I can say without a doubt that the single best class I ever took – the one that helped my professional career the most — was PR Writing, and letter grades were docked for each grammatical mistake. (Thanks, Professor Bodensteiner!)

Again we circle back to the insidious effects that placing education in a consumer/customer framework has wrought. Students have come to expect their education to be tailored to their own personal pace, likes, and abilities. This most definitely is not how it works in the business world, where your supervisors are catering to the market and to their customers, not to you. Students graduate as consummate consumers who are wholly unprepared to switch roles and take on the mantle of producers.

Not All 18-Year-Olds Are Ready for College

People mature at different ages and different rates. Some students are ready for college at 16 and 17 and go on to do very well. Some, however, are thrown out the door at 18 into a totally new world, and just aren’t ready for it. Even Brett details that experience in the introduction to Heading Out On Your Own; after floundering in his first semester at the University of Oklahoma, he had to move back in with mom and pop. Transitioning from the cocoon of home to all of a sudden living on your own and being entirely responsible for your life can be a bewildering experience.

There is actually quite a high dropout rate for college freshmen that doesn’t get enough attention in the media. One in four college freshmen drop out in that first year, and half of all college freshmen won’t ever earn a degree. Reasons cited do include academic skills, but the greatest factors are social and emotional – self-esteem, self-care, anxiety, depression, etc.

The company that administers the ACT test has found that students aren’t actually academically ready for college, either. They hold certain benchmarks to be “college ready†in the four subjects of the ACT test. Students deemed college ready in a particular subject have a 75% chance of passing a college course in that subject. In 2012, they found that more than 25% of students fell short in all four subjects, and over 60% fell short in two subjects. While this is a problem more related, perhaps, to our elementary and secondary school systems than the students themselves, the fact remains that many 18-year-olds simply aren’t ready for the rigors of college, either academically or socially/emotionally.

Now that we covered the bad news, let’s move on to the positives of attending a 4-year college.

The Pros of Attending a 4-Year College

The Vast Majority of Students Don’t Pay Full Sticker Price

While the sticker prices for a year’s worth of tuition at college can be quite shocking (New York University takes the cake at a whopping $62,000/year!), over 80% of all students receive some sort of financial aid. Between government Pell Grants, school-specific grants, and scholarships, there’s a lot of free money to be had that doesn’t take the form of student loans (and therefore debt).

The average student (at private universities) receives about $17,000 in financial aid, with about half of that being student loans and half being grants/scholarships. This means that out-of-pocket costs are lowered to an average of just over $11,000 per year, per student. That makes college much more manageable for families and individuals.

Many will complain that hours of filling out scholarship forms for a “measly†thousand dollars isn’t worth it, but when you’re out of college and paying back loans and trying to figure out how to balance your budget, you can be sure that that thousand bucks means a world of difference. With over $3.5 billion in yearly scholarship money available, it’s worth your time to go for it.

It should also be mentioned that many colleges have scholarships based on merit. If you do well, you’re more likely to receive scholarships without having to fill out any forms at all. After a rough first year of college, my GPA went up each year, and much to my surprise, when I was junior I was given a scholarship that all students in my degree program received with a GPA above a certain level. The better you do in school, the more financial aid you’re likely to receive. (It should be noted this is true of high school, too. If you’re on the honor roll in high school, you’re much more likely to receive automatic scholarships and grants.)

All of this is to say that the sticker shock of college prices doesn’t have to be so shocking. With the right financial aid package, many schools (including elite private colleges) become affordable – relatively speaking, of course.

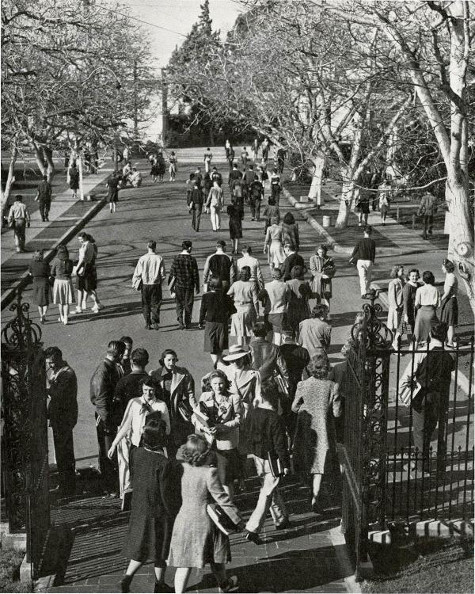

You Often Make Great, Lasting Personal Relationships

What’s interesting in talking with people about the benefits of their college experience is that it’s often the intangibles that take center stage. Whereas with the negatives, you can point to stats and specific institutional problems, there’s just something about college that people really love.

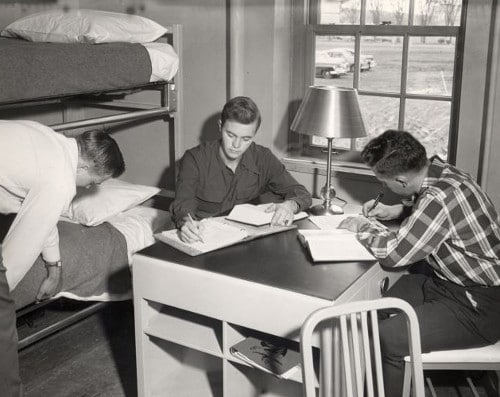

One of those somethings is certainly the unique relationships you make. At a four-year school, you’re surrounded by friends in the dorms at nearly all times; you have classes together, you eat all your meals together, you hang out playing MarioKart every night until 3am (was that last one just me?). When you spend that much time with people, you’re going to form very tight bonds. And because of that – spending so much time with friends – you end up having about the most fun on a daily basis that you’ll ever have. You don’t have the responsibilities of a full-time job or of owning a home, so you’re free to just hang out pretty much all the time with the people you care about. That’s a recipe for having a good time.

The reality is that outside of close environs like that, it’s harder to make friends. If you’re working full-time, living by yourself or with just a roommate or two, you’ll have to put in more effort to create those lasting relationships.

This is especially true in the dating world. Why do you think online dating has become so popular? Because outside of college – where you are no longer surrounded by people of roughly the same demographic – it’s just hard to know where to look for that special someone. You have bars, your workplace, and…that’s about it. So, people turn to online sites just because they don’t know where else to meet people. Connecting with your future spouse at college may save you from spending years surfing Match.com.

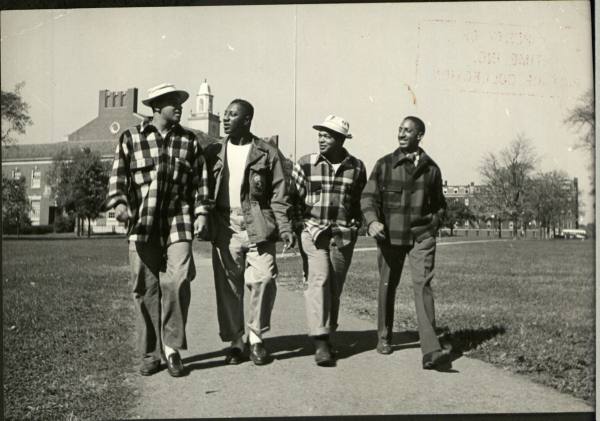

You Often Make Great, Lasting Professional/Mentoring Relationships

One of the great benefits of college, especially in regards to your professional career, is simply the astounding number of very smart, successful people you’re surrounded by, be they professors, advisors, deans, etc. Most colleges have internship programs, job boards, and entire staffs devoted to helping you land a job. Beyond that, professors often end up being the best connections and mentors you may ever have.

In talking with various people about their college experience, you often hear the fact that college “opened doors†for them. While not always articulated, this usually means they had some type of networking connection that got them in a door somewhere. My first internships related to my major came through professors who recommended me for those positions. Those internships gave me experience that led to full-time jobs. Doors opened.

Beyond just getting opportunities for jobs, you may also meet incredible mentors in college that serve as life advisors for decades, and will help you shape your own life philosophies (see below). Their benefit cannot be measured, and there are few opportunities outside of college for those types of relationships to be formed and fostered.

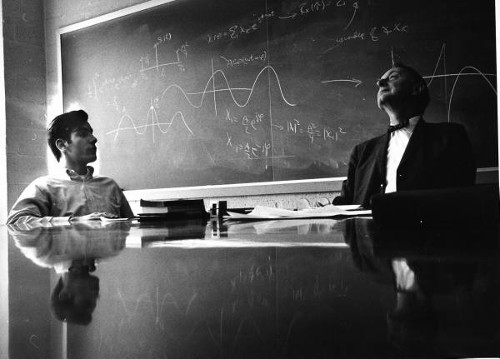

College Can Expand Your Mind and Your Horizons

While as mentioned above, college won’t necessarily expand your mind, it certainly has ample potential to do so. I know college was definitely a time for me of expanding my horizons and learning to think on my own. While vague, that’s without a doubt one of the most important things college did for me. Had I stayed close to home, or just gone right into the working world, I’m not sure how much I would have grown intellectually or emotionally. My worldviews changed quite dramatically over four years in college, and I’m quite thankful for that.

I was able to have my religious and political and philosophical views that I’d carried from my parents and my hometown really torn down, and then built back up again by what I found in my independent thought processes. Brett and Kate, and subsequently this blog, were greatly influenced by Professor J. Rufus Fears at the University of Oklahoma, who taught them the importance of extracting life lessons from history.

While tapping into the mind-sharpening power of college requires a student to be self-motivated and leave the path of least resistance by intentionally seeking out talented professors, rigorous courses, honors classes, and small seminars, the rewards can be incredibly worthwhile and truly unmatched.

The honing of your mind is not always something that can be done completely on your own. We often need a gentle push to do so. College was that trigger for me, and for many other people. While it takes the individual being in the right mindset for growth, if that’s in place, there are few better places than college for shaping a perspective and philosophy you’ll carry throughout the rest of your life.

A Degree Still Provides a Better ROI Than Just a High School Diploma

Although a college degree is not necessarily the investment it once was, or is promised to be, it still provides a better opportunity for employment and higher income than not having a degree.

The national unemployment rate is at around 6.7% right now. For college graduates (all college graduates, not just the recent grads I mentioned above in “Consâ€), that rate is just 3.4%. For those with just a high school diploma, the rate is more than double that at 7.3%.

I mentioned earlier that the ROI of college in terms of lifetime earnings over high school graduates, according to a PayScale.com report, was closer to about $500,000 than the $1 million often cited and touted. Their methodology is a bit complicated, though, and doesn’t include many small business owners, those who are self-employed, or freelancers/contractors. The real, tangible difference to me is in average yearly salaries. For college graduates, it’s $55,700. For high school grads, it’s $33,800. When doing the math over a 40-year career, that comes to a $876,000 difference over a lifetime.

While grit and hard work will go a long ways in the working world, the best bet for many people is to couple that determination with a college degree.

A Degree is Required for Many Jobs (Even Relatively Menial Ones These Days)

There are a huge number of jobs in this country that require a college degree. More likely than not, it’s actually just what will get you in the door for an interview rather than getting you the job itself. Is that chance for an interview worth up to $100,000 in debt? It certainly could be, if the job is well-paying and a great fit for your goals.

This is particularly true of “STEM†fields – science, technology, engineering, and mathematics. If you’re going into one of these fields, college is likely the right choice. Job postings in these categories outnumber all other job postings 3 to 1. Sure, you could become a master coder, drop out of school, and start Facebook. But that’s not likely. In these fields, a college degree is largely not only required, but crucial to understanding the work you’ll be doing on a daily basis. And these categories aren’t done growing – they’re expected to outpace normal job growth by about 10% in the next decade.

Aside from STEM fields, a degree is also a requirement for many mainstream jobs out there today. Be it non-profit, corporate, small business – owners and HR professionals will often throw out resumes that don’t list a college degree. Unfair? Certainly. Reality? Absolutely. A former supervisor of mine said it thusly:

“I have written job descriptions. I have written the hiring qualifications for various positions. There have been times that one of the jobs I was hiring for had the qualification of “Degree Required.†More often than not, this means a four-year degree required. Yes/No. Black/White. It’s a toggle switch. “Yes†means the candidate moves to the next pile of potential hires. “No†means… well, it means no. No, you don’t have an opportunity to interview for this job. No, you don’t get to talk to someone to show them how much experience you have. No, you don’t get to demonstrate that your actual experience in this exact field is possibly much more beneficial to the company than another person’s 4-year degree in General Studies or European History. Is it fair? Not always. Is it right? Not always. Is it in the company’s overall best interest? Maybe.

As an employer, here’s what a four-year college degree signifies to me, beyond subject knowledge:

1) You know how to set and achieve long-term goals (i.e. ‘graduate from college’).

2) You know how to prioritize and have the ability to put off the need for immediate gratification and see the bigger picture – at least sometimes.

3) You know how to be a part of a team – not necessarily sports related (there are few college graduates who have not had to work on at least one team project).

4) You are often self-motivating.

5) You probably know how to speak in front of a small group.

6) You probably know how to make a simple presentation.

7) You understand the concept of deadlines and consequences for missing those deadlines.

8) You know how to study and take notes.â€

This is how employers think, and how they perceive college graduates. Will this change in the future? Perhaps. But for now, this is the reality of the business world. I can say without a doubt that my own college degree opened doors that would not have been present otherwise.

Conclusion

There are more sides to this coin than expected, aren’t there? While many of these discussions surrounding college center on money, that’s not the whole story.

Even if it’s not “right,†the college experience is part of the American experience. Most people you encounter will have some amount of college under their belts, whether they earned a degree or not. Dorm life, cafeteria food, sporting events – these are all things we wax nostalgic about when thinking of the “good ole days.†There’s certainly something to be said about that. If there truly was no value to college, people wouldn’t do it. No matter how you look at it, the decision to go to college is a weighty one – one that 18-year-olds have a hard time processing.

It’s for this reason that we really advocate for taking a gap year. Have you ever wondered why it seems you have to go to college right after you graduate high school? Why must it be the automatic next step? More and more people are questioning this assumption and stepping off the education conveyer belt for a spell before deciding how they want to proceed.

Colleges are even starting to take notice of this fact. Amazingly, to me, they’ve started providing financial aid for students to first spend a year volunteering overseas or interning with a local company. The gap year is gaining steam, with a nearly 20% increase in students participating between 2006 and 2013. For good reason.

When you’re 18 you probably don’t know what you want to do with your life, what you want to major in, if college is really the right choice for you, or whether you’re emotionally ready to succeed if it is. So why figure out the answers to those questions while the debt-o-meter is running? A gap year (or two) allows you to mature, learn some life skills, serve others, see the world, and not only avoid debt, but maybe actually make some money. When the gap period is over and you enroll in college, you’ll have a much greater chance of being able to hit the ground running — lowering the possibility of flunking classes, changing majors three times, and taking six years to graduate.

Or maybe after your gap year you’ll decide that college isn’t the right choice for you after all. What other pathways might you take?

That is where we’ll turn in the next article in this series when we explore the alternatives to the 4-year college.

What were some of the pros and cons of your own college experience?

Tags: College